risks associated with closed end funds

Like a mutual fund or a closed-end fund ETFs are only an investment vehiclea wrapper for their underlying investment. Closed-end funds have their own investment objectives strategies and investment portfolios.

Understanding Closed End Fund Structures Nuveen

Closed-end funds arent always able to be redeemed at the end of the day.

. Diversifying across closed-end funds does little to reduce th. Closed-end funds can often be very volatile because their value can greatly fluctuate. Risks associated with closed end funds.

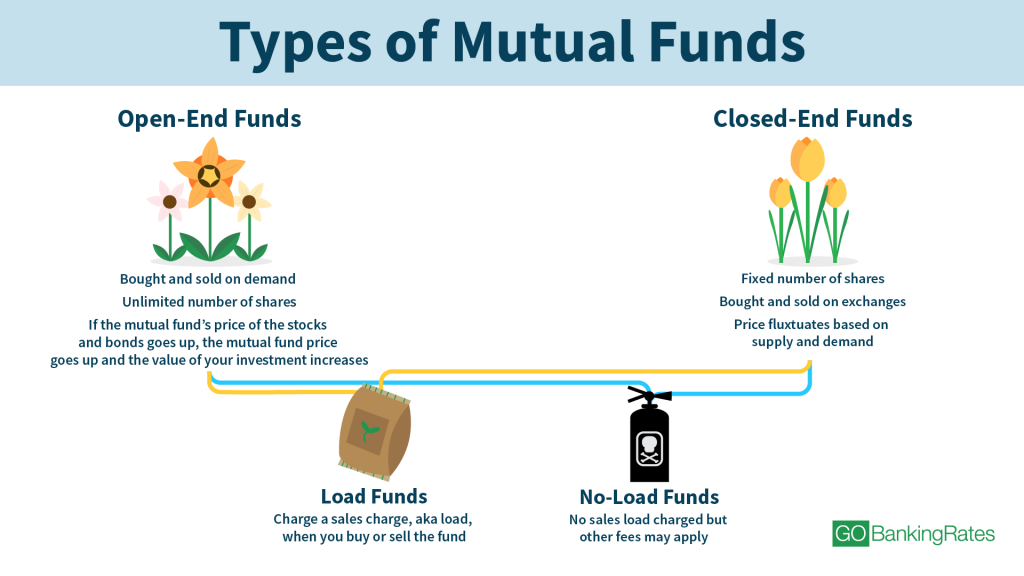

Just like open-ended funds closed-end funds are. Closed-end funds can offer opportunities but they come with risks Not nearly as popular as open-end mutual funds they provide advantages for long-term investors who can stomach some volatility. Open-end funds are the typical mutual fund you are familiar with in your 401k.

They also can be subject to different risks volatility and fees and expenses. Closed-End funds can also be highly volatile during adverse market conditions due to their structure. The leverage huge expense fees and uncertainty around the discount longer-term investors are usually better off with an ETF.

What VaR model parameters does a fund have to use. Market price riskSince a closed-end fund trades in the secondary market and essentially has a fixed amount of shares outstanding the market price may display more volatility than the NAV potentially subjecting an investor. This site does not list all of the risks associated with each fund.

The risks associated with closed-end funds. Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. These are exchange-traded funds ETFs that are at the mercy of the levels of supply and demand among investors.

There is no guarantee a funds investment objective will be achieved. Investors should contact a funds sponsor for fund-specific risk information andor contact a financial advisor before investing. What are the risks associated with Closed-end Funds.

There can be no assurance that fund objectives will be achieved. Like any investment product closed-end funds offer opportunity but also come with a number of risks some of which are listed below. Where a fund may have provided tax indemnities after the event in relation to known tax issues and where there are issues over the validity of a tax position.

As always it is important to consider the objectives risks charges and expenses of any fund before investing. Now we will discuss risks associated with CEFs. Not every risk factor in this list will pertain to each closed-end fund.

Directors and managers of closed-end funds beware. Closed-end funds have the ability to use leverage which can lead to greater risk but also greater rewards. Based on these risk factors and others not every fund may be suitable for all.

So if you buy an SP 500 ETF and the SP 500 goes down 50 nothing about how cheap tax efficient or transparent an ETF is will help you. The single biggest risk in ETFs is market risk. Closed-End Fund Association Along with the usual risks associated with investment in equity markets such as market risk inflation risk political risk etc.

Irradional noise traders earn high returns for bearing risk that they themselves create. Open-end funds and closed-end funds. See Characteristics of Interval Funds below.

The funds VaR model must take into account and incorporate all significant identifiable market risk factors associated with a funds investments. Other fund operational risks may arise following the termination of the fund such as the following. You see there are two different categories of mutual funds.

For closed-end funds with then-outstanding shares of preferred stock the VaR must not exceed 25 of the value of the funds net assets. Closed-end funds are the lesser-known cousins of the mutual funds you know and love. This site does not list all of the risks associated with each fund.

Trading in such portfolios requires research and analysis before such investment. Shares can trade at a deep discount and it can often be difficult to realize the true value of the shares. Credit Risk Credit risk is the risk that the issuer of a security will default or unable to meet its obligations to pay interest or principal as scheduled.

The first closed-end funds were introduced in. Other fund operational risks may arise following the termination of the fund such as the following. But be sure you weigh the.

Closed-end fund historical distribution sources have included net investment income realized gains and return of capital. General Risk Factors Related to Closed-End Funds. Closed-end funds may permit shareholders to redeem shares at specified intervals such as quarterly.

Prices may swing from one high value to a low value point all in one days trading action. Your introduction to closed-end funds. Shares of closed end funds in secondary markets are often accompanied by high volatility in trading.

If you look at those three big risks in closed end funds. There are varying levels of risks associated with each closed end fund. The following list of risk factors provides a review of those associated with generalized closed-end fund investing.

When a closed-end fund launches its IPO it puts a prespecified number of shares up for sale and it generally doesnt issue new shares or redeem old shares. Investing in a closed-end fund is appropriate for a more experienced investor. The Securities and Exchange Commission is worried about significant compliance and risk management issues associated with such funds.

Closed-End Funds Offer Yield But Beware Of The Risks Closed-end funds can provide much better income yield than youd get from most bonds or certificates of deposit. Risk factors pertaining to closed-end funds vary from fund to fund. Closed-end fund historical distribution sources have included net investment income realized gains and return of capital.

This increases the risk and possibly the return. Closed-end Fund Ratings. Seeks to outperform the stock market c.

For closed end funds that hold fixed income securities in their portfolios the risk can be significant. Investing in closed-end funds involves risks. Principal loss is possible.

What Are Closed End Funds Forbes Advisor

What Is The Difference Between Closed And Open Ended Funds Quora

/bonds-lrg-2-5bfc2b24c9e77c00519a93b5.jpg)

Open Your Eyes To Closed End Funds

Understanding Return Of Capital Closed End Funds Nuveen

Difference Between Open Ended And Closed Ended Mutual Funds

What Is The Difference Between Closed And Open Ended Funds Quora

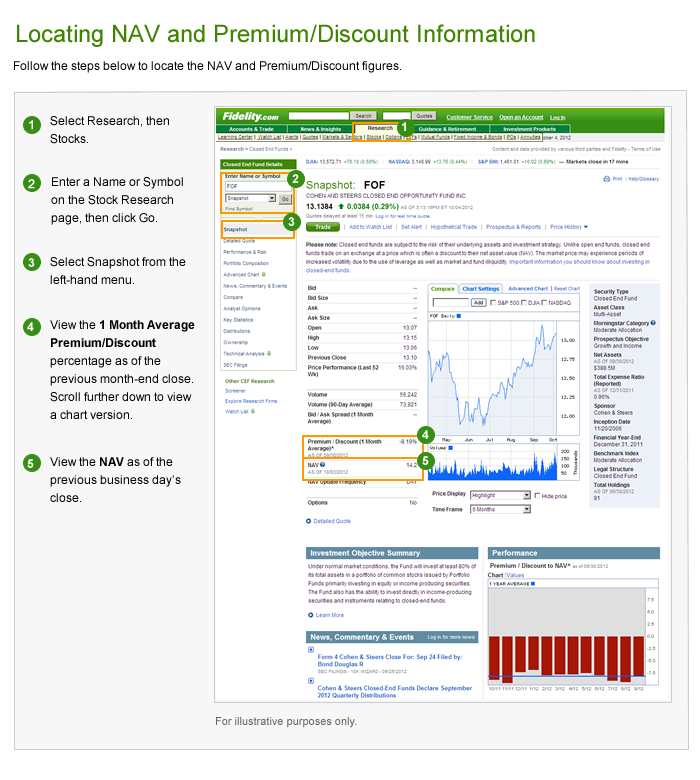

What Are Closed End Funds Fidelity

Guide To Closed End Funds Money For The Rest Of Us

Mutual Funds Everything You Need To Know Gobankingrates

Understanding Closed End Fund Structures Nuveen

Guide To Closed End Funds Money For The Rest Of Us

A Complete Guide To Investment Vehicles Money For The Rest Of Us

Closed End Fund Cef Discounts And Premiums Fidelity

What Is The Difference Between Closed And Open Ended Funds Quora

Investing In Closed End Funds Nuveen

Guide To Closed End Funds Money For The Rest Of Us

What Is A Closed End Fund And Should You Invest In One Nerdwallet

What Is The Difference Between Closed And Open Ended Funds Quora

/MutualFund2-0ca2ba12fdc4424cb0e4155bf9ef3c25.png)